Solopreneur or extensive company, every business needs concrete goals. Utilizing objectives and key results (OKRs) or sticking to tried-and-true SMART goals, setting effective goals can transform your business, while subpar goals can vanquish everything you’ve worked so hard for.

Whether you teach people how to find the best car insurance from your local insurance company or you’re a broker comparing the best platforms for experienced investors, setting goals properly can give you the chance to help more customers, earn more profits, and better your business overall. Beginner goal-setters and experienced professionals alike can utilize OKRs to build your insurance company, investing platform, or other company to the level you aspire to.

Track your goals.

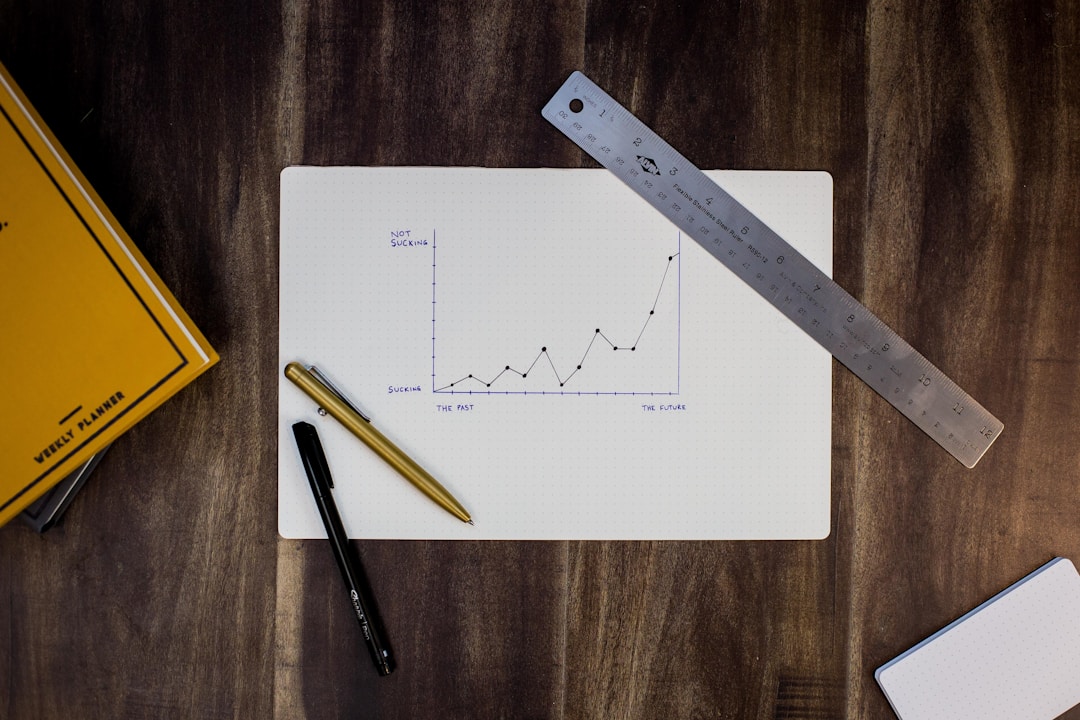

Without keeping track of your goals, you’ll struggle to envision your progress. If a broker wants to double their commission this year but doesn’t track their progress, it’s easy to reach November with minimal progress. By utilizing OKR tracking systems, mobile apps, or other tools, auto insurers, brokers, and professionals in all fields are able to clearly see a tangible representation of your results and how efficiently you’re moving towards them.

Each time you log into your account, you’ll see your quantitative progress, whether that’s car insurance sales, new mutual funds, or another number entirely. Your specific goals will help you determine the best method to track them. If you’re working towards greater profits, you might want to use a graphical representation of your earnings over time, detailing every new car insurance policy or mutual fund you set up.

Setting objectives and key results upfront will ensure you have a tangible factor to track. For example, your OKRs will include a few measurable outcomes. Those progressive outcomes will help you see whether you’re moving towards your objectives and key results successfully.

Communicate your goals.

From the start, sharing your goals with everyone involved is important. Whatever way you’re choosing to track your goals, it’s important to communicate your progress to your team members or other stakeholders, whether that’s active investors or your fellow auto insurers, brokers, or position of choice. Without clearly defined OKRs, your team will struggle to work towards them—and you’ll face a far greater challenge in trying to meet them.

This is true whether you’re managing a global auto insurance company or you occasionally work with contractors in your one-person show. Add employees to your tracking software account or share updates along the way. If your OKRs involve driving new customers to your insurance company or trading more ETFs, ensure that every member of your team knows that. Without explaining your goals to whoever else is working towards them is key to meeting them effectively.

Balance large and small goals.

You know that it’s important to dream big when you’re setting goals for your business. But, if your dream is too lofty, you might struggle with overwhelm. To combat this, be sure to include an assortment of smaller goals as well as your larger-scale dreams. Spend time breaking down your big goals into smaller steps to make them more manageable.

If your OKR plan involves doubling your profits, for example, work out how many car insurance quotes or new active trader accounts—you’ll have to make to reach that goal. Then, break that goal down further into specific milestones. At each step along the way, make sure that the decisions you make bring you closer to the next milestone. As a result, you’ll be consistently aligned with your long-time goals.

Adjust your goals.

While it’s important to work towards your goals, it’s equally critical to remain flexible. OKR software, in particular, pays attention to making sure you can adjust your plans as needed, whether that’s new auto insurance rates or unique investing strategies. Your objectives and key results can change over time—that doesn’t mean you’ll derail your progress. The best way to make progress towards your loftiest goals is to be prepared to change the steps you’re taking to reach them or to even change the ultimate goal.

Maybe the market changes and a mobile app becomes the most effective way to open new brokerage accounts or auto insurance policies. Perhaps you’ll offer discounts on insurance rates to bring customers to your company, adjusting the number of sales your insurance company will need to make to meet your OKRs.

Whether you run a car insurance company or are helping beginners reach their personal investing goals, goal-setting techniques and best practices are critical to hitting your OKRs—your goals. You want your customers to make a great choice in choosing you to supply their car insurance, mutual fund, or brokerage account. Offering them a discount on car insurance or finding the perfect ETF for a new investor will let you become the best car insurance company, trade platform, or other business.